RCO Finance Scam was brought up in 2024 and 2025. It had vowed to deliver an AI-based DeFi with enormous capabilities. Around 36 million dollars were raised in a long presale by the investors. It all went wrong at launch, however. You might have lost money. Within 30 minutes of trading on BitMart, the RCOF token crash erased close to 99 percent of the value of the tokens. This paper describes the occurrence. We do not complicate matters.

What Was RCO Finance Scam and Its Hype?

RCO Finance identified itself as the next big DeFi based on AI. Few experts announced that it would combine crypto with stocks and AI. They displayed a gaudy website and whitepaper. It was made to look real through influencers and a whiteboard demonstration. No marketable good was about, though. The AITrading platform was not a live application but rather a demo screen.

In 2024-25 the project had an RCO Finance presale. Thousands of users joined. They would be able to purchase the RCOF token (the cryptocurrency of the platform). RCO Finance scam indicated that the token would offer special features and staking rewards. They went to the extent of declaring collaboration with large technology and brokers. However, all of those partnerships were spurious crypto partnerships. Indicatively, the whitepaper of RCO boasted of collaborating with Hyperliquid, Alpaca Markets and Interactive Brokers. None of the companies affirmed any deal. They did not give announcements or evidence of RCO Finance connections.

Fake Promises: Partnerships and Licenses

The RCO Finance whitepaper had numerous assertions. They have guaranteed a brokerage crypto license by August 2024. That would enable them to provide ETF and stock trading through crypto. That date expired without making any announcement. No license in public and no paperwork. Actually, there are no records of official regulators of RCO Finance Scam. The platform was selling tokens but it was a rogue crypto project that was posing as a legitimate one.

They also purported luxurious associations with actual companies. Indicatively, RCO stated that it was the core team with Hyperliquid in terms of zero-gas trading. It also stated that it was using Alpaca Markets and Interactive Brokers. But on examination, those assertions disintegrated. These deals were not heard by anybody outside RCO Finance. It was not supported by any technical documentation or press releases of the large companies. In brief, these were phony crypto alliances. The group just placed such logos in the marketing without authorization.

No Real Product: The Beta Was a Sham

RCO Finance teased a beta platform in early 2025. It allegedly possessed AI-based portfolio management and 285,000 users. However, the truth of the matter was different. It was only a demo of the platform provided to users. It did not really have any smart contracts or AI engine. You would be able to log in and have a dashboard but not to trade or to connect your wallet. It felt as though it was a mock-up of a video game.

The fake platform was later eliminated. No actual trades and user screenshots were evident. It was a hollow shell to him who came to see it. The zero-gas trading on Hyperliquid did not appear. The AI robo-advisor was never effective. All the large features were kept on paper. Such an empty demo is a huge warning sign. One of the reports describes RCO Finance as raising millions and bringing nothing.

Community Warnings: Telegram Censorship

Investors became suspicious soon. Hard questions in the Telegram chat of RCO Finance were not answered. Actually, individuals were prohibited on Telegram to enquire about basic things. Should somebody say, “Can we see the platform? Or where is the evidence of partnering? Moderators simply deleted the messages and banned users. Even a writer of Medium published pictures of this. They filmed the instances of RCO community members being kicked out following friendly inquiries. That is a sign of trouble. Authority projects do not gag evidence seekers.

In one of the analyses, one of the authors wrote: That is correct! We were reported and forbidden Telegram. It is too suspicious to be prohibited from asking questions. It implies that the project did not desire individuals to be aware of the issues. Proper crypto communities embrace inquiries. In the case of RCO, however, anything that was critical was deleted. This mass censorship of RCO Finance Telegrams ought to have been a cause of concern.

Anonymous Team and Broken Promises

Their team was never didxed at RCO Finance either. They indicated that they would expose team members even suggesting a former Microsoft board member by mid-2025. On social posts, there was a teaser of a May 31, 2025, meet the Power Team. None of the names or profiles appeared. It does not yet have an about us section on the site. Neither LinkedIn nor legal company information was shared. The question was also how this project was run.

In Aug 2025, another press release said that a Big Tech investor associated with ChatGPT was supporting RCO. It reported that one of the Big Tech giants which had earlier invested in the early days of ChatGPT, joined them. That was a suggestion of Microsoft or Google. But, again, it was false. Not a piece of evidence, no name dropped, no confirmation of the companies. This was an unwarranted boast to attract more people.

In general, all of the grandiose promises made by RCO Finance collapsed: there were no partnerships, no licenses were obtained, and the staff was in the shadows. The red flags accumulated at the beginning. The token crash eventually came as the biggest red flag.

BitMart Listing Crash and Lack of Liquidity

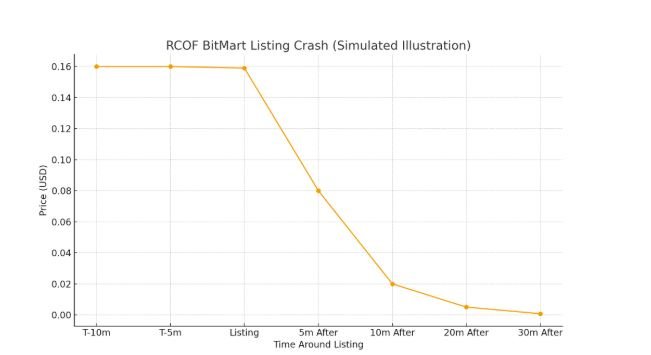

RCOF eventually made it to BitMart in October of 2025 after a lengthy presale. This was to be the momentous moment. Instead, it ended in disaster. The project is alleged to have reserved 12 percent of the tokens as liquidity approximately 135 million RCOF. However, the fact was that virtually no liquidity was availed.

The token was traded at approximately the presale price (0.16). However, it went down by 99.5 within half an hour. It fell as low as $0.00079. That’s almost zero. All that was wiped out in less than 20,000 worth of selling pressure. Consider that: a 36 million presale project lost 99 percent of its value on twenty grand.

Here’s a chart of that crash: It shows a huge red candle. When the token was listed on BitMart and on a few Uniswap liquidity pools as well, it became virtually useless. This is usually the trend when it comes to crypto presale frauds. The crew was listed on an exchange with the aim of dumping the tokens. Buyers did not have a means of selling since there was no actual liquidity. It was more of a trap smart contract honeypot: you could purchase tokens, but not sell them without bankrupting the price.

Promised Tokenomics vs Reality

RCO Finance possessed an official tokenomics plan. The supply of RCOF was 1.124 billion. They stated that half of it was to sell publicly, 4 percent to the team, etc. Paperwise it was a bit normal. They also provided a token diagram and an audit by SolidProof.

However, information in the audit made it problematic. The report prepared by SolidProof demonstrated that the owner of the contract had special powers. The owner was allowed to charge to buy/sell taxes up to 25, no address fees, and switch the fees on or off. That is, the team would be able to modify the rules post-launch. This is dangerous. These privileges were audited as potentially allowing the owner to build a honeypot smart contract situation. That would give them the option of allowing people to sell RCOF tokens but not to sell them. This was in line with user experiences as tokens could not be sold easily.

So even though they stated that there was fair distribution, the audit indicates otherwise. Theoretically, locking the team for 3 years was good. However, when the team is free to set their fees at will and blacklist wallets, then those locks will not safeguard investors. It is an additional big investor alerting that something was amiss. A similar pattern of misleading claims appeared in other crypto cases too, as discussed in our detailed breakdown of the Elon Musk XRP rumors.

Withdrawal Issues and Investor Complaints

Prior to the crash, things were already not going well. Numerous individuals who purchased during the presale received no tokens or struggled to withdraw the tokens. Users on social media and review sites alleged withdrawal problems on the presale platform.

One big site reported: “Most investors claim that they never obtained their tokens. The Trustpilot reviews also echoed the same: the motifs of not getting tokens and being unable to get a refund were not an exception. Even the BitDegree review reported the initial user worries regarding the withdrawal of money. When you are forced to ask yourself whether you should withdraw or not, then it is a red flag.

All these user warnings cumulate. Money was lost or even got stagnant. There was no way to rely on the platform. Some investors attempted to refer to the BitMart crash as a rug pull – basically a scam in which founders absconded with funds. In fact, there is evidence of a planned fraud, but not an honest failure.

Key Lessons and Steps to Avoid a Crypto Presale Scam

If this sounds bad, it is. But we can learn from it. The following is a naive tutorial on how you and I may verify crypto presales as a scam such as RCO Finance.

- Check the Audit Details: Audit is not a magic stamp that is safe. Examine the auditor of the project such as SolidProof and what they audited. Did they cover all contracts? It was audited at RCO Finance, though not all functions were audited. When there is a half-baked audit or the audit is lost, then be suspicious.

- Inspect Liquidity on the Blockchain: View the liquidity pool with the help of such tools as BscScan. Is the amount of money raised big enough? The pool was minute in the case of RCO, in comparison to the presale of 36M. When the liquidity is contributed by one wallet or when it is extremely low, that is a massive red flag.

- Run a Honeypot Test: Sites such as honeypot. DEXTools can be used to confirm whether a token is a honeypot or not. This translates to being able to purchase and not sell. There was suspicious behavior of the token of RCO Finance. It is always a good idea to make a test purchase of a very small size to ensure that you will be able to sell off the token later.

- Verify the Team’s Identity: The actual projects are most often associated with actual individuals. Verify LinkedIn profiles, background, and previous projects of the founders. The team of RCO Finance scam was unknown and was also offering a dox-x that was not realized. Be very careful in case the project presents cartoon avatars or gives some ambiguous bios. When a project boasts of big partners, then check out whether they are really discussing the project. If not, it’s likely false.

- Confirm Exchange Listings for Real: Open the real exchange site to check the listing of the token. According to RCO Finance, it will be on BitMart and provided screenshots, though you are to check the official site of BitMart or Twitter. Most of the scams include bogus listing announcements. Believe not a picture, a Telegram message.

- Read Community Feedback: Search Reddit, Twitter/X, and Telegram using the name of the project along with such keywords as scam, audit, or withdrawal problems. As an instance, enter in search RCO Finance scam, RCOF rug pull, etc. When numerous users complain about the same issue, such as a freeze withdrawal or a post is deleted, it is a red flag. In the case of RCO, dozens of users were complaining of locked funds and censored questions.

These steps will not make you safe but they will go a long way. This simple vetting which should be done with caution, will save your cash.

Conclusion: Stay Safe in Crypto

The case of RCO Finance is one that should be learned from by all crypto investors. It demonstrates how slick marketing can conceal a crypto presale fraud. A large presale increase is not indicative of safety. The promises and lots of money given by RCO Finance failed miserably.

Use our steps above. Talk to other investors. When it seems too good to be true, then it typically is. The crypto world can be both thrilling and dangerous to U.S investors and to all other people around the world. Such projects as RCO Finance take advantage of the hype regarding new technologies (such as AI) and buzzwords to deceive people. They can even be listed in an exchange such as BitMart so that they appear to exist but vanish.

We wish you knew better by telling you this story. The question of whether or not RCO Finance is a legitimate company will now be answered definitively: A swindle and a warning lesson. Always take your research and take a simple check before you start investing in any crypto presale.

FAQ about RCO Finance Scam

- Is RCO Finance a scam or legit?

Many signs point to a scam. Millions were raised but the project was unable to deliver what it promised. Research discovered phishing partnerships, the absence of an actual product, and the loss of money by token holders.

- What happened to the RCOF token?

RCOF had nearly no liquidity when it listed on BitMart in October 2025. The price fell by 99.5 percent in a few minutes. The crash that followed left it with little of its value. Customers were unable to dispose of without destroying the price.

- How can I avoid a crypto presale scam?

Follow the 6 steps above. Team liquidity, team info, and team audit. Do a small test buy/sell. Read reviews and Reddit. In case of wallet withdrawal problems or deleted posts in Telegram, avoid it.

- What should I learn from RCO Finance?

Those great promises (AI, great investors, great raises) should be examined. Even big presales are frauds. Always do their due diligence and never spend money that they are not willing to part with in untested projects.